Optimize your assets with our expertise

For more than 25 years, Necker Finance (Suisse) SA has been helping high-net-worth individuals to protect, structure and enhance their wealth.

Our partners: Necker Finance (Suisse) SA has signed partnerships with the most prestigious banks and insurance companies.

Our expertise

Since 2000, Necker Finance Switzerland has been helping its customers to manage their wealth by offering tailor-made solutions to meet their financial, inheritance and asset management objectives.

This success is due above all to the quality of the research and advice we provide to individuals and families, as well as to entrepreneurs and institutions.

As specialists in asset management, we work within an open architecture, offering a wide range of products and services, enhanced by the wealth management support provided by our subsidiary, Avacore Wealth Planning.

A three-way relationship, the heart of our business

Le client est au cœur de nos priorités. Il bénéficie de l’accompagnement d’un gérant de fortune dédié, son interlocuteur privilégié et permanent.

Quelle que soit la banque retenue, le gérant assure un suivi personnalisé de qualité, faisant le lien entre vous et la banque dépositaire.

Après une analyse des besoins, le client ouvre par notre intermédiaire, son compte auprès d’une banque partenaire qui sera le dépositaire de ses avoirs. A ce titre, elle assure l’administration du compte, la conservation des titres ainsi que l’exécution des instructions qui lui ont été transmises par notre intermédiaire.

Après une analyse rigoureuse avec son gérant, un profil d’investissement est établi qui correspond à ses besoins. Le client signe ensuite un mandat de gestion ou de conseil qui régit sa relation avec Necker Finance (Suisse) SA. Ce mandat nous autorise à gérer la fortune du client auprès de la banque dépositaire à l’exclusion d’acte de disposition.

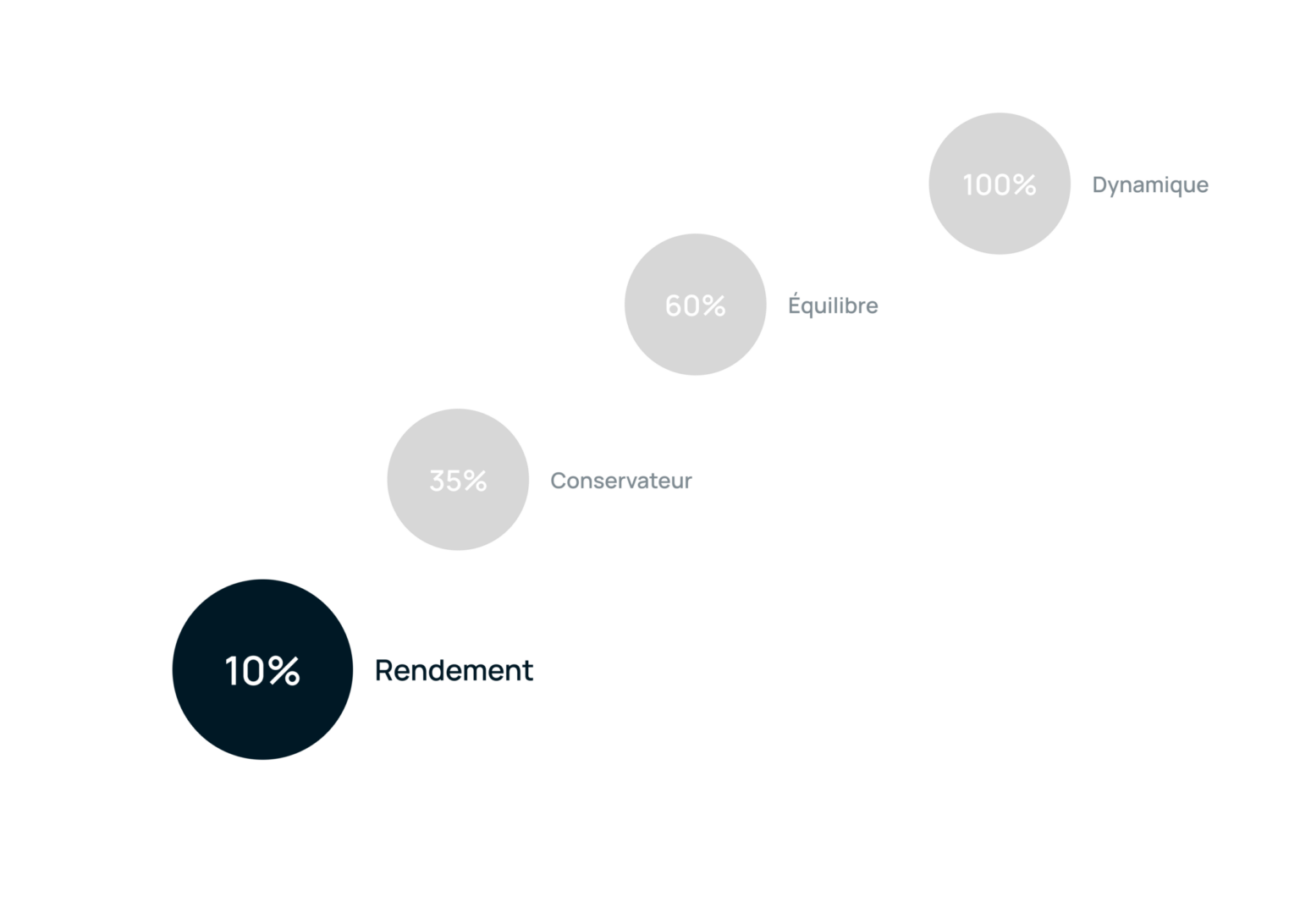

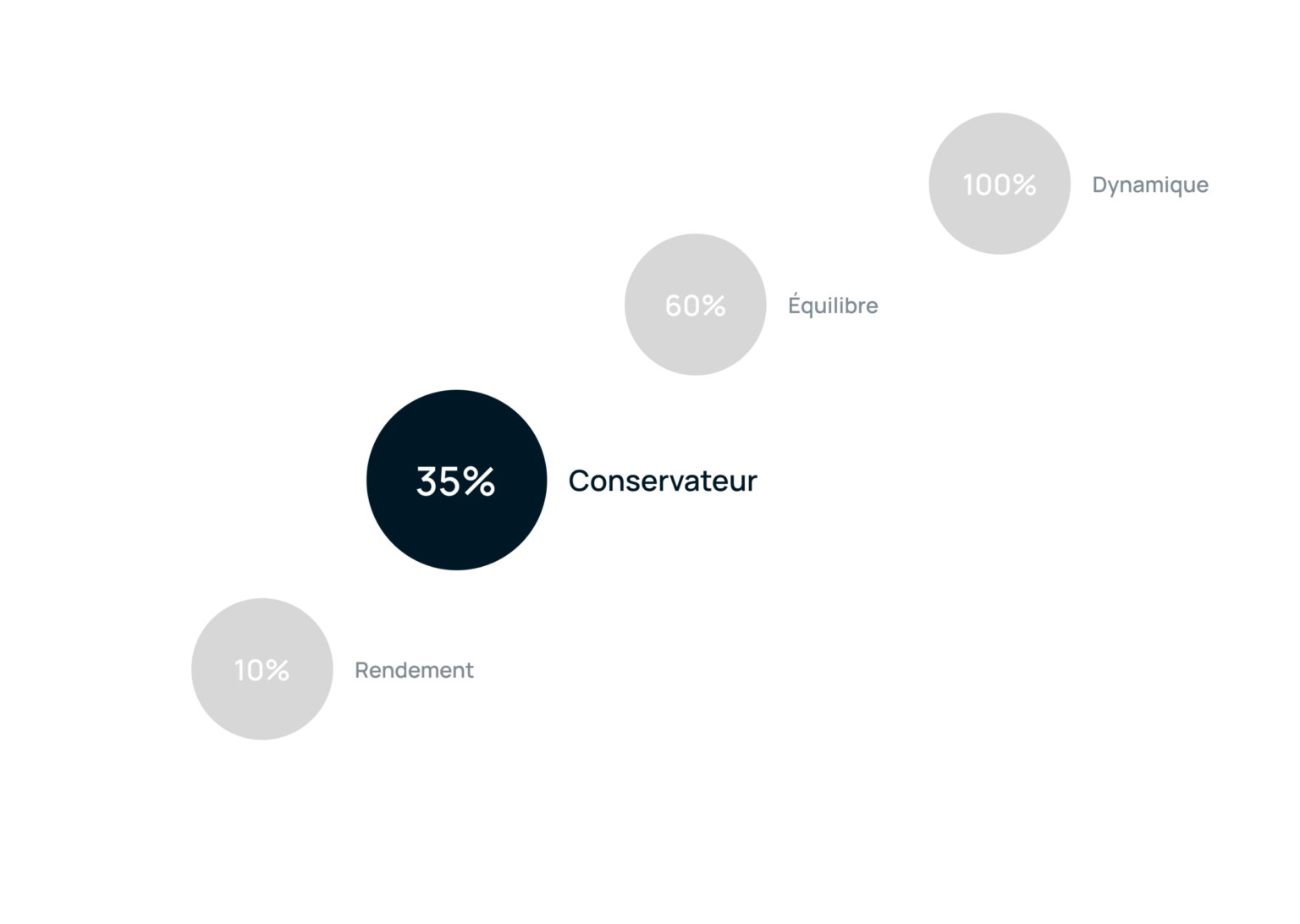

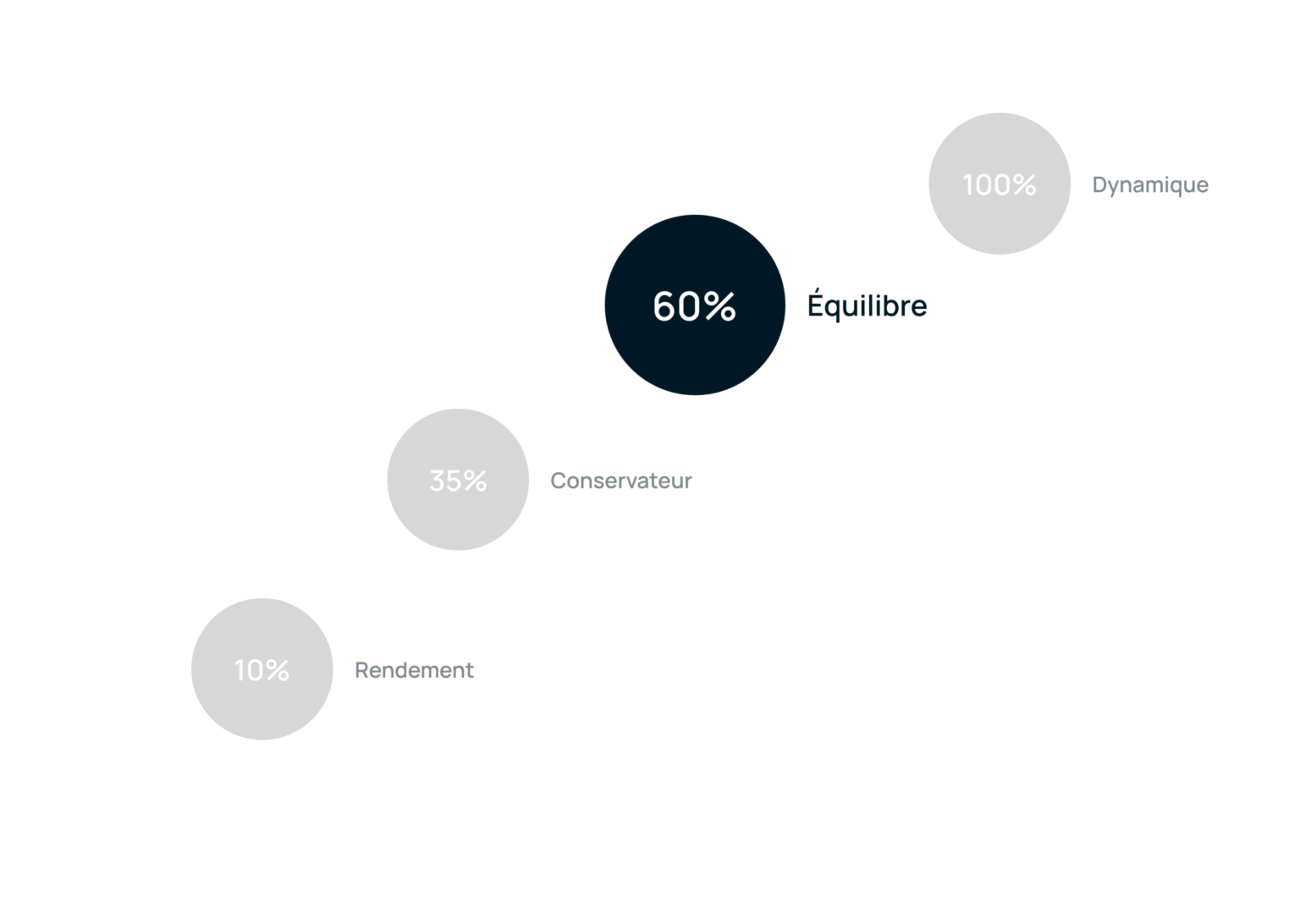

Personalized portfolio and financial risk management

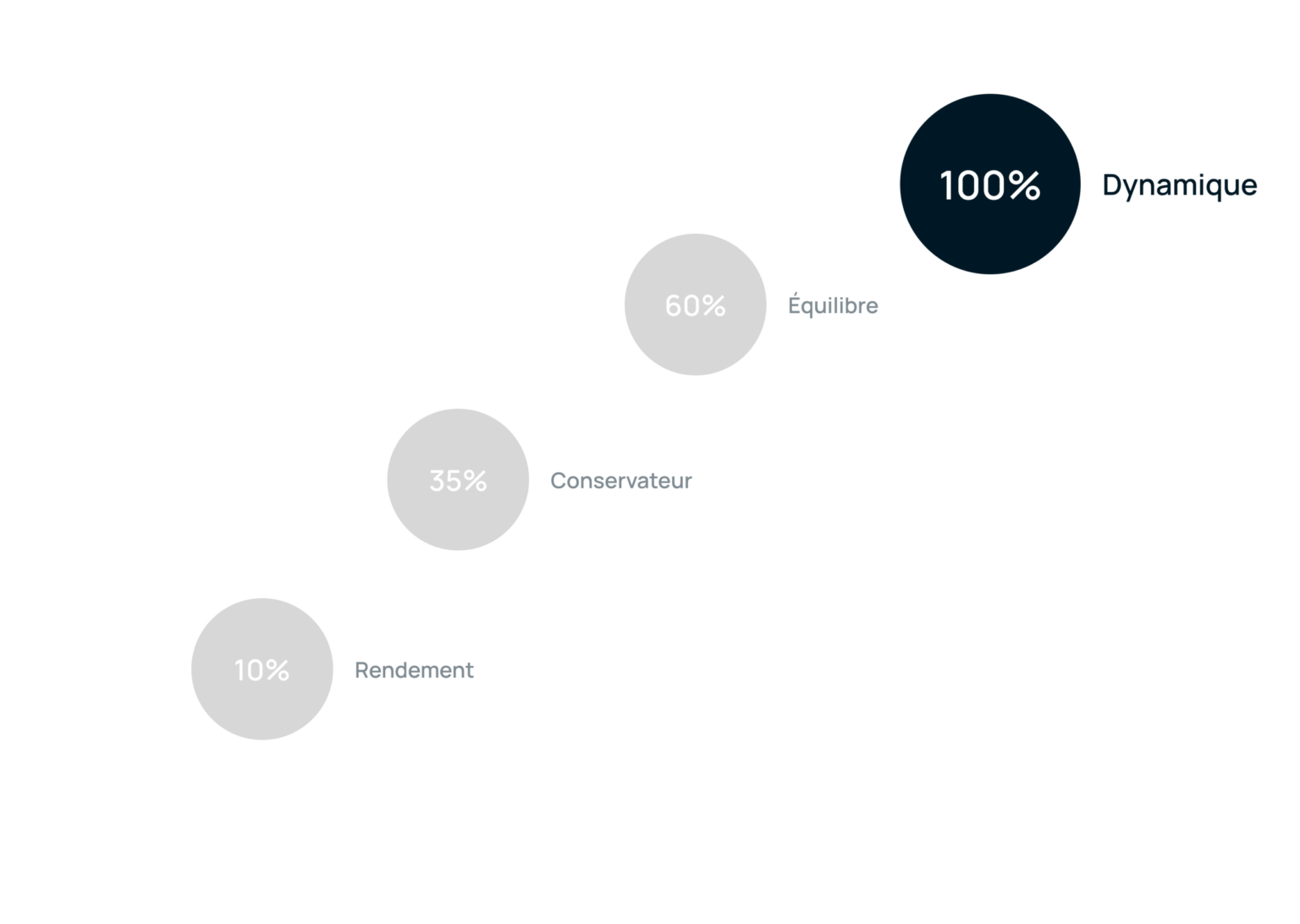

This simulator allows you to evaluate the level of risk associated with your investments. You can use this tool to better understand different investment strategies.

Yield - 10% (Low Risk)

Composed of a minimum of 90% fixed-income investments (cash, bonds, money market funds, alternative products) and a maximum of 10% equities.

Conservative - 35% (Moderate Risk)

Composed of a minimum of 65% fixed-income investments and a maximum of 35% equities.

Balanced - 60% (High Risk)

Composed of a minimum of 40% fixed-income investments and a maximum of 60% equities.

Dynamic - 100% (Critical Risk)

Yield - 10% (Low Risk)

Composed of a minimum of 90% fixed-income investments (cash, bonds, money market funds, alternative products) and a maximum of 10% equities.

Conservative - 35% (Moderate Risk)

Composed of a minimum of 65% fixed-income investments and a maximum of 35% equities.

Balanced - 60% (High Risk)

Composed of a minimum of 40% fixed-income investments and a maximum of 60% equities.

Dynamic - 100% (Critical Risk)

Managed freely and without constraints. Investment options: 100% shares.

Composed of a minimum of 90% fixed-income investments (cash, bonds, money market funds, alternative products) and a maximum of 10% equities.

Composed of a minimum of 65% fixed-income investments and a maximum of 35% equities.

Composed of a minimum of 40% fixed-income investments and a maximum of 60% equities.

Managed freely and without constraints. Investment options: 100% shares.

Necker Finance (Suisse) SA in figures

All our experts at your service

In an increasingly complex financial world, every investor needs a close, loyal, attentive, available and stable wealth manager with the necessary expertise in financial markets, wealth engineering, inheritance and taxation. The complementary nature, experience and multidisciplinary skills of our teams enable our customers to find the right answers to the many financial and wealth management challenges they face.

SAVONA Sandra

GARDINI Paolo

PELLOUD Marc

LABRY Gilles

Our services

We support you in managing and optimizing your wealth with a strategic and personalized approach, from financial planning to asset management. We work with you to define the best investment solutions, whether listed or unlisted. In partnership with financial institutions we offer a discretionary management service tailored to your profile and objectives. Whether you wish to retain control or delegate the management of your portfolio, our solutions are tailored to your level of risk and your ambitions.

DRAG to discover our services